Backloading Installments

Overview

When an installment plan changes from a longer cadence (such as full-pay) to a shorter cadence, this will shift installment dates to the future. This can cause a credit for the insured to be generated. This topic describes the default system behavior in such a situation.

We’ll describe an example where:

A policy is created with an annual term, effective January 1 to January 1

There is $1200 annual premium charged

When first issued, it is on a full-pay invoice, and the insured has paid the initial invoice in full

Effective halfway through the term, on July 1, the insured requests to shift to a monthly installment cadence, in order to temporarily use the pre-paid premium amount

Note

There are many possibilities that work with this behavior, such as charging increased premium amounts or assessing fees along with the change, or making other changes to coverage. Those situations will work in a similar way to this simplified example

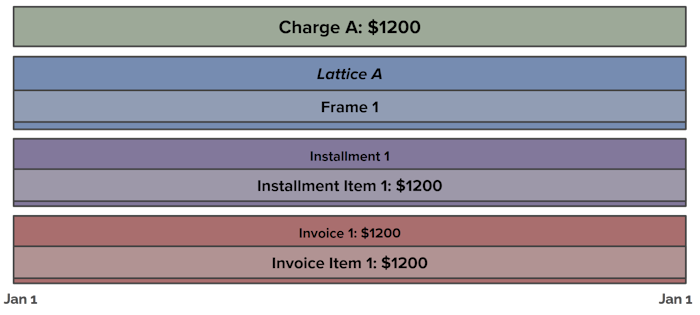

Initial State

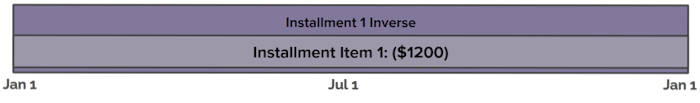

Initially the policy has a single Charge for the $1200 premium, along with an installment lattice and installment, and the invoice has been generated and paid:

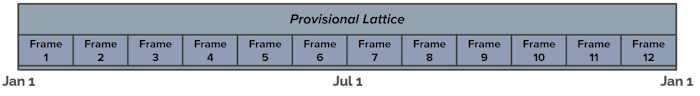

Lattice Creation

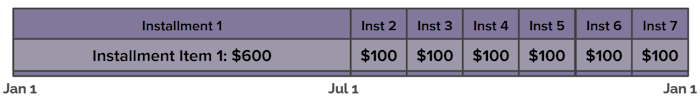

When the installment cadence is changed effective July 1, the first thing that has to happen is creation of an updated installment lattice, which is the template for dividing charges into individual installments. The process starts with computing what the lattice would look like if the new monthly cadence were to be effective across the entire term:

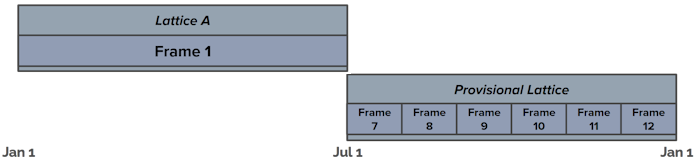

Then we consider the part of the original lattice before the effective time of the change, along with the part of the new lattice after the change effective time:

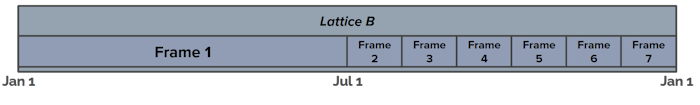

These two halves are combined to create a new lattice:

Charge Processing

Next we create an installment based on offsetting the original charge as it was scheduled with the old lattice, since the change’s effective time occurs during that existing charge:

And then we can apply the charge to the new lattice, which yields these installments:

Invoicing

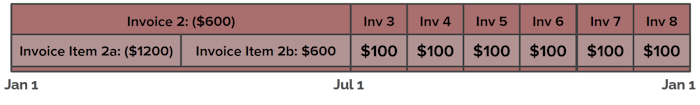

Now with the new installments, invoicing going forward will look like this:

Results

After all the changes, we have this:

The original $1200 invoice remains as it was, fully paid.

Immediately a new invoice for negative $600 is generated.

The negative invoice settles automatically and the $600 is sent to the customer’s credit balance.

The credit balance may be disbursed when desired

Six monthly invoices will be generated for $100 each, starting July 1, as adjusted for lead times as desired according to the installment plan settings.

Note

Upcoming features will support automatically handling the excess credit balance with automation based on configurable rules.