Disbursements

Overview

Disbursements are a feature that provide a controlled way to return credit amounts to the insured. These credits may arise in circumstances such as:

Overpayments of invoices

Cancellations

Policy changes that reduce premiums

Shifting from a front-loaded installment schedule such as

fullPayorannuallyto a more even schedule such asmonthly

In cases like this, excess credits will accumulate in an account’s Credit Balance and can then be drawn upon with a payable disbursement.

Note

An invoice with a negative balance (sometimes called a Credit Memo) will not result in an immediate refund to the insured, even though such invoices will be settled immediately upon generation. The purpose of the credit balance is to hold the credit amount so that the refund process can be managed. To automatically return these funds, see the Excess Credits Feature Guide.

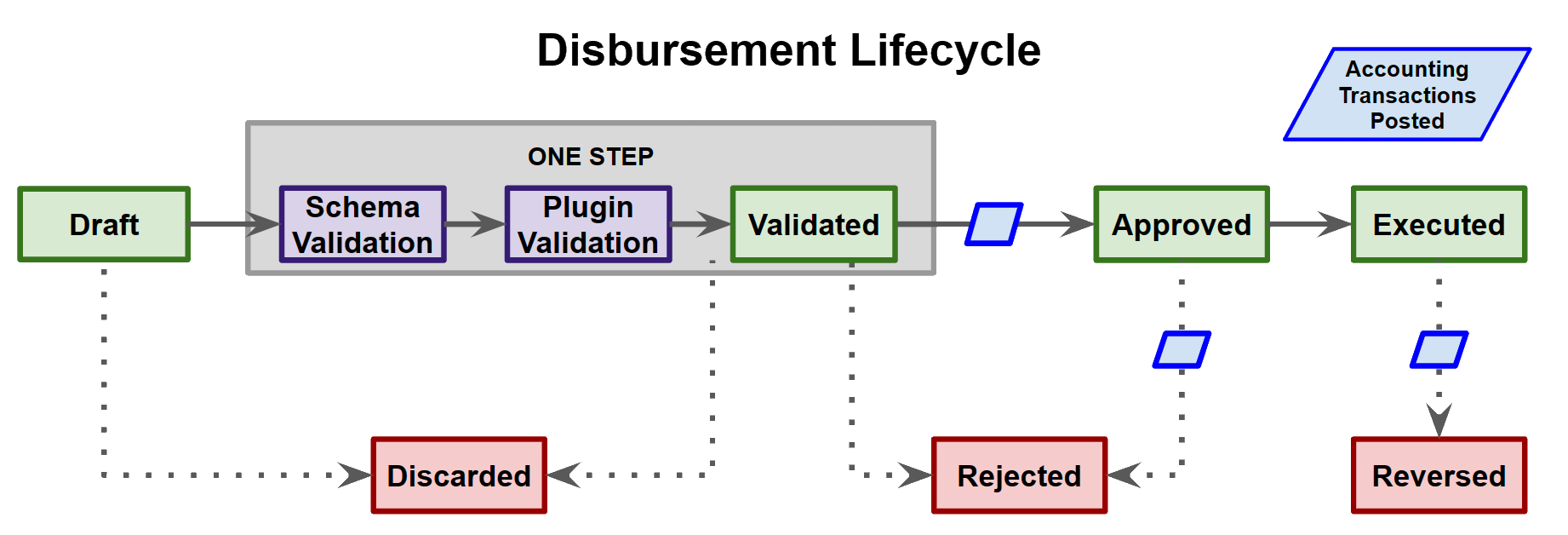

Lifecycle

Disbursements start in draft state, and the normal progression is from there to validated, approved, and finally executed.

A disbursement that has become validated but hasn’t been executed yet may be reset, which pulls it back to draft state where it can be modified. Only draft disbursements can have their amount or other data changed.

A disbursement that has been validated or approved can be explicitly rejected, to signify that the disbursement has been disallowed.

Disbursements in draft or validated state may be discarded.

An executed disbursement may be reversed to reflect that the outgoing payment has become invalid for some reason.

The states reversed, rejected, and discarded are terminal; the disbursement cannot be used after it reaches any of these states.

Note

Permissions can be used to ensure that proper separation between disbursement creation, modification, and approval is maintained.

Credit Sources

Disbursements are structured so that they may draw upon multiple sources. Currently only the Account’s credit balance and individual invoice items that are credits may be used as a source. If the amounts to draw upon for each source are not specified, then the ones with larger credit amounts will be used first.

Important

Disbursements cannot use sources that belong to other customer accounts.

Financial Instruments

The destination for the disbursement can be specified with a financial instrument, which will be reflected as an external cash transaction in the DisbursementResponse.

Configuration and Data Extensions

Disbursements can be configured with different types and each type can specify a unique structure for data extensions. Disbursements are declared as top-level items in the configuration file.

Accounting

When a disbursement is approved, the source or sources of the disbursement will be drawn down (debited) to fund the disbursement (which is a credit). When the disbursement is executed, the disbursement will be debited, and the corresponding cash account will be credited. If the sources for the disbursement do not provide sufficient credits to reach the amount of the disbursement, the approval will fail, even if the authorized user has approved the transaction.

If an approved disbursement becomes rejected, an accounting transaction will revert its funds back to the original sources, and the disbursement will then have a zero balance.

On reversal, both the above transactions will be effectively reversed, such that the amounts drawn from the disbursement sources are restored, and the disbursement itself will remain having a zero balance.